Table of Contents

Investing for the long term is a journey that requires attention and regular adjustments to keep you on track.

While setting up an investment portfolio is the first step, maintaining it through portfolio rebalancing is what truly ensures that you achieve your long-term financial goals.

Whether you’re aiming for financial stability in retirement, saving for your child’s education, or simply building wealth over time, portfolio rebalancing is key to staying aligned with your objectives.

What is Portfolio Rebalancing?

Portfolio rebalancing is the process of adjusting the proportions of different asset classes (like stocks, bonds, and mutual funds) in your investment portfolio to maintain a desired level of risk and return.

Over time, the value of your investments fluctuates, leading to a shift in your original asset allocation. By rebalancing, you bring your portfolio back to its original or desired asset allocation to ensure it aligns with your risk tolerance and financial goals.

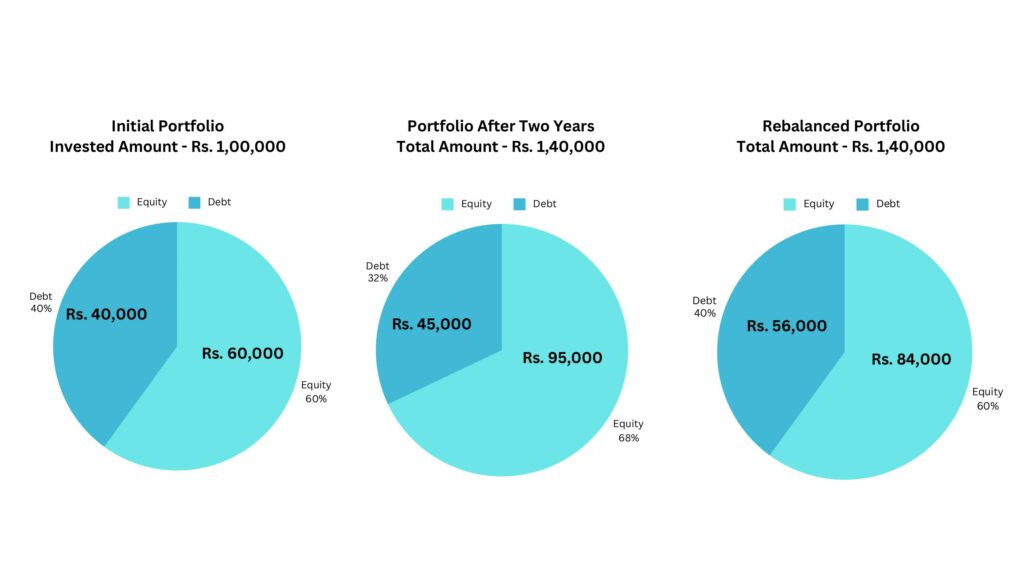

For instance, let’s say you started with a 60/40 portfolio, where 60% of your investments were in stocks and 40% in bonds. You invested a total of ₹1 lakh—₹60,000 in equity and ₹40,000 in debt.

Over time, your equity investments performed well, growing to ₹95,000 in two years, while your debt fund grew to ₹45,000.

Total investment after 2 years: ₹1,40,000

Equity investment: ₹95,000 – 67.85%

Debt investment: ₹45,000 – 32.14%

As the returns changed, the asset allocation percentage of your portfolio also shifted. This is why rebalancing becomes essential.

After rebalancing: Total investment: ₹1,40,000

Equity: ₹84,000 (sold equity units worth ₹11,000) – 60%

Debt: ₹56,000 (bought debt units worth ₹11,000) – 40%

Why is Portfolio Rebalancing Important?

One common question that arises regarding rebalancing is

“The equity portion of the investment has outperformed bonds and delivered larger returns. Doesn’t this mean it has the potential to continue generating higher returns? Why should I rebalance? Why not let it grow?”

The reality is that past performance is not a reliable indicator of future returns. The reason you initially chose an asset allocation—whether 60/40 or 70/30—was based on factors like your age, risk tolerance, and investment goals. That allocation is purposeful.

Equity funds indeed have higher growth potential, but they also come with greater risk. On the other hand, debt funds offer more stable returns with lower risk compared to equities.

Now, imagine you didn’t rebalance your portfolio, expecting similar returns from the equity portion, and then the market takes a downturn. If your equity fund performs poorly and loses 10%, while your bond fund generates a 12% return, the results would be:

Without Rebalancing:

Total investment after 2 years: ₹1,40,000

Equity investment: ₹95,000 (67.85%) — 10% loss – ₹85,500

Debt investment: ₹45,000 (32.14%) — 12% gain – ₹50,400

Total Value after 3 years: ₹1,35,900 – 3% loss

With Rebalancing:

Equity investment: ₹84,000 — 10% loss – ₹75,600

Debt investment: ₹56,000 — 12% gain – ₹62,720

Total Value after 3 years: ₹1,38,320 – 1.2% loss

Even though the equity market performed poorly, the rebalanced portfolio would have limited the impact, resulting in a loss of just 1.2%, compared to the 3% loss in the non-rebalanced portfolio.

The key takeaway is that you cannot always predict how the market or specific asset classes will perform. For example, the Nifty 50 index has seen returns as high as 75% (2009) in a single year but also a decline of 51% (2008) in another.

If the stock market rebounds in the next year after the downturn, your equity fund might recover or even outperform, while the previously overlooked portfolio may gain less value.

But, a rebalanced portfolio ensures that you maintain your preferred balance between risk and return. Most importantly, it allows you to live your life with peace of mind, freeing you from constant worry about your investments.

Investors with higher risk tolerance can handle more equity exposure, while those who prefer stability—like risk-averse investors—tend to choose fixed-income funds/debt funds, accepting lower returns for greater security.

“Know what you own and know why you own it”

Peter Thiel

Types of Portfolio Rebalancing

Rebalancing helps keep your investment portfolio aligned with your goals by adjusting asset allocations. Here are some common types of portfolio rebalancing strategies to consider.

Calendar Rebalancing

This straightforward approach involves adjusting your portfolio at set intervals, such as annually, quarterly, or monthly. It’s easy to manage and reduces costs since it involves fewer trades.

However, it doesn’t account for sudden market movements, which may result in missed opportunities to rebalance when necessary.

Percentage-of-Portfolio Rebalancing

This method involves setting a threshold, such as 5% or 10%, and rebalancing whenever any part of your portfolio moves beyond that range. It’s more reactive to market shifts but may require more frequent adjustments to maintain the desired allocation.

Tactical Rebalancing

Tactical rebalancing is a more hands-on approach, where adjustments are made based on your outlook on market conditions. Rather than sticking to fixed percentages, you make changes depending on your market insights.

This strategy requires more market knowledge and active involvement.

Constant-Mix Strategy

In this strategy, rebalancing is done regularly to keep your asset allocation at the target levels. It demands more effort and attention, but it ensures that your portfolio stays aligned with your desired asset mix, preventing significant deviations over time.

Buy-and-Hold Strategy

Though not a rebalancing strategy in the traditional sense, the buy-and-hold approach allows your portfolio to drift with market conditions.

Investors following this strategy typically only make major adjustments when their financial goals or risk tolerance shift, rather than frequently rebalancing.

Points to Consider When Rebalancing Your Portfolio

Understand Your Financial Goals: Before rebalancing, revisit your financial objectives, investment horizon, and risk tolerance. Tailor your rebalancing approach to support your unique investment goals.

Evaluate Your Current Portfolio: Review your portfolio’s asset allocation and performance. Identify any deviations from your original strategy that may need correction.

Set a Clear Rebalancing Strategy: Determine your approach to rebalancing—whether tactical, constant, or another method. Having a clear strategy ensures you stay focused and avoid emotional and reactive decisions.

Tax Implications and Transaction Costs: Rebalancing can result in tax consequences due to gains or losses from selling assets, which may affect your tax liability. It’s important to consider tax-efficient strategies in this process.

Additionally, be mindful of transaction costs; make sure that the benefits of rebalancing outweigh these expenses.

Diversification: Diversification is key to reducing portfolio risk. Aim to maintain a well-diversified mix of assets to help protect against market volatility.

Regular Review: Make regular portfolio reviews and rebalancing a part of your investment routine. This helps ensure you stay aligned with your target allocation over time.

Stay Informed: Stay updated on market conditions, economic trends, and any significant changes in the investment landscape. Being informed enables you to make better decisions about your portfolio.

Emotional Discipline: Avoid letting emotions dictate your investment decisions. Rebalancing should follow a planned strategy, not reactions to short-term market movements or fear of missing out.

Document Your Decisions: Keep track of your rebalancing moves and the rationale behind them. This not only provides clarity but also helps you learn and refine your strategy over time.

Seek Professional Guidance: When it comes to investment strategies and rebalancing, consider seeking professional guidance.

Experienced financial experts can assist you in navigating the rebalancing process and optimizing your strategy, ensuring that your decisions are informed and aligned with your financial goals.

Why Professional Guidance is Important in Portfolio Rebalancing

Navigating the intricacies of portfolio rebalancing can be challenging, but seeking the help of financial experts can provide significant advantages.

These experts will help you understand your unique financial situation, goals, and risk tolerance and execute a tailored rebalancing strategy that aligns with your objectives.

Having professionals manage your investments brings organization and clarity to your financial journey, ensuring thorough documentation of all decisions and actions.

Additionally, their involvement helps reduce the likelihood of emotional buying and selling, allowing you to stay focused on your preferred asset allocation for various investment goals.

In a constantly shifting financial landscape, their expertise can be crucial for maintaining a balanced and effective investment strategy.

In summary, while rebalancing is an essential part of portfolio management, professional support can enhance your ability to navigate this process effectively, helping you achieve your financial goals with greater confidence and security.

Finding a Trustworthy, Certified Expert is Easy Now

Finding a reliable professional to execute your investment strategy can be challenging in today’s market. That’s where Moolaah comes in.

Moolaah is an investment services platform that connects you with certified financial experts who are AMFI-registered mutual fund distributors.

In a sea of self-proclaimed financial experts, Moolaah offers a curated list of qualified professionals, making it easy for you to assess their expertise and experience.

This allows you to choose the right expert tailored to your needs. With the right support, you can confidently implement your investment strategies through Moolaah and work towards achieving your financial goals.