Table of Contents

Remember the savings jar from your home when you were a child? It was a simple box where mothers tucked away small amounts from tight budgets, keeping it as a reserve for small future needs, like buying something for themselves or their children.

This humble act taught us the importance of consistent saving—a lesson that resonates deeply with modern financial planning.

We all dream of owning a luxury car, living in a cozy home, or enjoying a secure retirement.

Yet, our monthly earnings often struggle to align with these dreams. This is where mutual funds, especially Systematic Investment Plans (SIPs), step in as a practical and achievable solution.

What is SIP?

A Systematic Investment Plan (SIP) is a structured and consistent way to invest in mutual funds. It involves setting aside a fixed amount at regular intervals—whether monthly, quarterly, or semi-annually.

This structured approach not only simplifies investing but also encourages consistent savings over time.

With SIPs, your money is invested in a professionally managed, diversified portfolio of assets, which helps spread risk and improve potential returns.

One of the best parts about SIPs is that you don’t have to worry about timing the market—a challenge even for seasoned investors.

By investing regularly, regardless of market fluctuations, you can benefit from rupee cost averaging, which can smooth out the cost of your investments and enhance your overall outcomes.

SIPs are a convenient and reliable strategy for working toward your financial aspirations.

With patience, consistency, and a focus on the long term, they can help you stay on track and achieve your financial goals.

Let’s consider a practical scenario: You begin investing at 30, aiming to retire at 60. You decide to set aside ₹10,000 every month for mutual fund SIPs, expecting an annual return of 12%. Additionally, you plan to increase your SIP amount by 10% each year in line with your growing income.

Over 30 years, this disciplined approach could grow your investments to approximately ₹8.83 crores!

This example highlights the potential of SIPs to bridge the gap between consistent effort and significant long-term results.

However, it’s important to consider the inflation rate, which is around 6-7% as of now. Inflation will diminish the value of money over time, reducing the actual purchasing power of your investment corpus when you retire.

Therefore, it’s crucial not to keep your money in low-return investments. If your returns don’t outpace inflation, the real value of your investments will be significantly eroded, limiting your financial goals.

Remember, some mutual funds have delivered even higher returns—above 30% annually on an average over the last three years—making SIPs an attractive choice for investors looking to achieve financial security.

As of November 2024, there were 10.23 crore SIP accounts in India and a total of ₹25,320 crore raised through SIP contributions during the month.

This shows the growing interest of investors and the rising popularity of SIPs. (Source: AMFI)

How to Invest in SIPs?

Starting and managing a Systematic Investment Plan (SIP) is simple and involves just a few straightforward steps:

1. Set Your Financial Goals

Start by identifying your financial objectives. Are you saving to fund your child’s education, retirement, buying a house, or something else?

Your goals will help determine the type of mutual fund you should choose: For eg,

- Equity Funds: Great for long-term goals (5+ years) when you’re aiming for higher returns with higher risk.

- Debt Funds: Perfect for short-term goals, offering more stability with lower risk.

- Hybrid Funds: A balanced mix of equity and debt, ideal if you prefer a moderate-risk approach.

These are just a few examples, and there are many other mutual fund options available based on your risk tolerance, time horizon, and financial goals, such as Tax-Saving Funds (ELSS), which offer tax benefits under Section 80C in India, or Sectoral Funds, which focus on specific industries like technology, healthcare, etc – and more.

2. Perform a Risk Assessment

Before investing, understand your risk tolerance to decide how much risk you can handle. Ask yourself:

- Are you comfortable with fluctuations in the value of your investments?

- Are you prepared for potential short-term losses for the chance of higher long-term gains?

Based on your risk assessment, choose funds that align with your comfort level, such as:

- High Risk: Equity funds (potential for higher returns, but with more volatility)

- Low Risk: Debt funds (safer, but with potentially lower returns)

- Moderate Risk: Hybrid funds (a balance between equity and debt)

3. Determine Your Budget

Decide how much you can comfortably invest every month. Use a financial calculator to ensure your SIP amount aligns with your goals.

A popular budgeting guideline is the 50-30-20 rule, which divides your income as follows:

- 50% for essential expenses like rent, groceries, and EMIs.

- 30% for discretionary spending, such as entertainment and vacations.

- 20% for savings and investments.

When allocating the 20% for savings and investments, ensure you’ve already built an emergency fund and covered health or life insurance outside this portion. If so, you can consider investing the entire 20%.

If your monthly salary is ₹50,000, you can invest ₹10,000 (20%) of it. Here’s how you can allocate this amount:

- 70% (₹7,000) goes into mutual fund SIPs.

- 30% (₹3,000) invested in safer options like fixed deposits (FDs) or gold.

Note: The 50-30-20 rule and this asset allocation is a general framework. If you can allocate more than 20%, it’s even better. On the other hand, if your expenses are higher and you can’t set aside 20%, start with 10%. It all depends on your financial situation and responsibilities. But the most important thing is to start as early as possible.

4. Choose the Right Mutual Funds

Take the time to research and select the mutual funds that best suits your needs, focusing on:

- Historical performance

- Expense ratio

- Fund manager’s track record

- Risk level and investment objective

In addition, it’s important to choose a suitable asset allocation within your mutual funds based on your investment objectives and risk profile.

Allocate your investments across different fund categories (equity, debt, hybrid, etc.) to ensure that the risk and return potential align with your goals.

For instance, you might choose a higher proportion of equity funds for long-term growth if you have a higher risk tolerance or more debt funds if you prefer a safer, lower-risk option.

Within equity mutual funds, you can further diversify the allocation into large-cap, mid-cap, small-cap, and other categories based on your investment objectives and risk tolerance.

If you’re uncertain about your risk profile or how to allocate your funds, consider consulting a mutual fund distributor for personalized guidance. They can help educate you about various mutual funds and suggest options that align with your financial objectives.

Platforms like Moolaah can help you find and connect with AMFI-registered distributors who have the right expertise and qualifications, making it easier to choose the right fund and start investing.

Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time.

~Warren Buffet

5. Open an Account

To start investing in SIP, you’ll need an account with a mutual fund house, broker, or investment platform. Here’s how to get started:

- Complete the KYC (Know Your Customer) verification process—it’s a simple process to confirm your identity.

- Link your bank account so that your SIP payments can be smoothly deducted each month.

- Set up auto-debit instructions to ensure your investments are automatically made on time, without any effort on your part.

6. Set Your SIP Date and Start Investing

Choose an SIP date that falls a few days after your salary credit to ensure sufficient funds for auto-debit. Maintain a reserved amount equal to one month’s SIP in your account to avoid missed payments.

Once your account is set up and you’ve selected your fund, initiate your SIP by choosing an investment frequency (monthly or quarterly) and ensuring timely contributions for consistent investing.

7. Monitor Your SIP

While SIPs rely on consistency, it’s important to periodically review your investments. Check the performance of your SIP annually, and adjust if necessary. Avoid making impulsive decisions based on short-term market fluctuations.

8. Adjust SIP as Needed

If your financial situation changes, you can increase or decrease your SIP amount or switch funds to better align with your evolving goals.

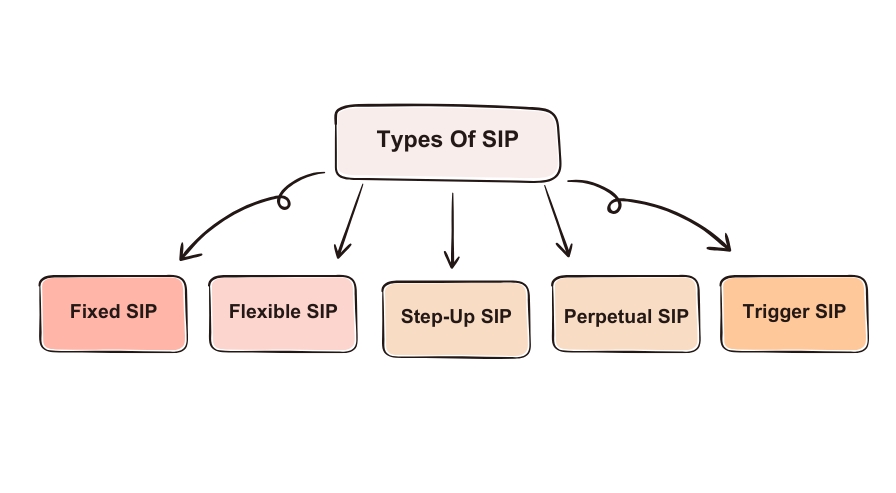

5 Types of SIPs

As you understand how to invest in SIPs, it’s now time to understand which type of SIP to start investing in.

SIPs come in different forms to suit the varying needs of investors. The below categories are based on how flexible the investment amount is and when contributions are made.

1. Fixed SIP

A Fixed SIP involves investing a predetermined amount at regular intervals—typically monthly. This approach is ideal for individuals who value consistency and stability in their investments.

Salaried employees or those with a fixed monthly income often find this option suitable, as it aligns seamlessly with their budgeting plans.

Benefit: If you invest ₹5,000 every month, you continue contributing the same amount regardless of market conditions. Over time, this discipline can lead to substantial growth due to the compounding effect.

2. Flexible SIP

A Flexible SIP allows investors to adjust their contribution amounts depending on their financial situation.

This option is perfect for individuals with variable incomes, such as freelancers, entrepreneurs, or those undergoing temporary financial changes.

Benefit: If your income is higher in certain months, you can increase your contribution. Similarly, you can reduce it during months when expenses are higher. This flexibility ensures you don’t stop investing entirely.

3. Step-Up SIP

A Top-Up SIP enables you to gradually increase your investment amount at regular intervals, such as annually. This helps keep pace with rising incomes, inflation, and financial aspirations.

By gradually increasing your contributions, you can enhance the growth potential of your investments without having to put in extra effort.

Benefit: If you start with ₹5,000 per month and increase it by 10% annually, both your contributions and returns will grow steadily, helping you reach your financial goals faster.

- ₹5,000/month invested in an SIP for 20 years with an expected annual return of 12% will grow to ₹49.95 lakhs.

- However, if you apply a 10% annual step-up to your contributions, the same ₹5,000/month starting point grows to ₹99.44 lakhs over 20 years, with the same 12% expected return.

4. Perpetual SIP

Unlike regular SIPs with a fixed end date, a Perpetual SIP continues indefinitely until the investor decides to stop.

It is ideal for long-term financial goals such as retirement planning, buying a home, or funding a child’s education.

Benefit: Perpetual SIPs encourage disciplined, long-term investments without the pressure of setting specific timelines.

5. Trigger SIP

Trigger SIPs are tailored for experienced investors who want to automate their investments based on specific market conditions.

These SIPs activate or adjust when pre-set triggers are met, such as a particular market event, a target NAV (Net Asset Value), or a specific time-based condition.

Benefit: They allow you to invest strategically during favorable market movements, maximizing returns.

Note: Trigger SIPs require a sound understanding of market dynamics, making them more suitable for knowledgeable investors.

Sail Toward Your Financial Goals with SIP & Expert Guidance

Investing through SIP is a powerful and consistent way to achieve your financial goals. The key to success lies in selecting the right mutual funds that align with your objectives and risk tolerance.

The benchmark index Nifty 50 has delivered an impressive average annual return of 20%+ over the last 10 years!

While it’s possible to navigate this journey on your own—tracking market trends, analyzing fund performance, and managing your portfolio—it can quickly become overwhelming and time-intensive.

Why shoulder all that stress when you can have an expert by your side?

Think of it like embarking on a voyage to a treasure island: with an experienced navigator, you can confidently adjust your sails to catch the right winds, steer safely through the waters, and stay on course toward your destination.

In the world of mutual funds, that experienced navigator is an MFD—Mutual Fund Distributor—who is a certified professional registered with the AMFI (Association of Mutual Funds in India).

An MFD simplifies your investment journey by educating you about different mutual funds, helping you choose the right funds based on your financial objectives and risk tolerance, and executing personalized investment strategies

And more importantly, it’s easy to find qualified and experienced mutual fund distributors now. Platforms like Moolaah act as a bridge between investors and MFDs.

Through Moolaah, you can access a vast list of MFDs, review their experience and expertise, and select the best one that fits your needs.

These MFDs offer personalized guidance and ongoing support—from fund selection to regular portfolio reviews.

Build your financial ship with the steady force of SIPs, and feel every wave of progress bringing you closer to your treasure.

With Moolaah and the expert guidance of an MFD, you’re not just navigating the seas—you’re sailing confidently toward your financial future.

Start today and set sail toward your dreams, because the journey to your financial treasure begins with just one step – the first SIP!

A journey of a thousand miles begins with a single step

~Lao Tzu