Table Of Contents

- Introduction

- The Rise of AI in Financial Sector

- Robo Advisors Enters The Market

- Evolution of AI in Investment Services

- The Future of AI in Finance

- How to use AI in your investment journey?

Introduction

The rise of artificial intelligence (AI) has sparked a profound transformation across various industries and the transformative impact it has had on the sector of finance is becoming evident now. From helping breakdown complex mathematical problems to automating portfolio management or risk assessment, the effects of AI in finance have permeated deeply.

In particular, the integration of AI in financial technology (fintech) and its role in aiding investment decisions have proven to be game-changers.

AI’s ability to analyze vast amounts of data, identify patterns, and make insightful predictions has revolutionized traditional investment strategies, offering unparalleled advantages to investors.

In this blog, we explore the impact of AI on the investment world, its rise and evolution, and strategies for leveraging its potential in your investment journey.

The Rise of AI in Financial Sector

Before diving into how AI is impacting the current investment landscape with numerous AI-powered platforms available to assist you in your investment journey, it’s important to understand how it all began.

Despite its current prevalence and common use, AI’s roots stretch back several decades, with its application in the finance sector gaining momentum starting in the 1980s.

Edward Feigenbaum introduced “Expert systems”, a form of artificial intelligence (AI) designed to replicate the decision-making skills of human experts in specialized fields like medicine, finance, or engineering.

In 1982 James Simons, a renowned mathematician founded, Renaissance Technologies. The firm utilized a petabyte-scale data warehouse to analyze statistical probabilities for securities price trends across various markets. These models are developed on extensive data analysis, enabling predictions based on non-random movements.

In 1986, Applied Expert Systems (APEX), also known as PlanPowerOne, made history as the first expert system to assist with financial planning for individuals earning over $75,000 annually.

From the 1980s onwards AI became an integral part of the finance sector, revolutionizing the industry and continuing to evolve through updates and the introduction of new systems. This evolution aims to enhance efficiency and reduce errors in financial processes.

2000s -AI in Finance Open to Everyone -Robo Advisors Enters The Market

Even though AI technology initially catered to the needs of financial institutions, it became easily accessible to the general public in the 2000s.

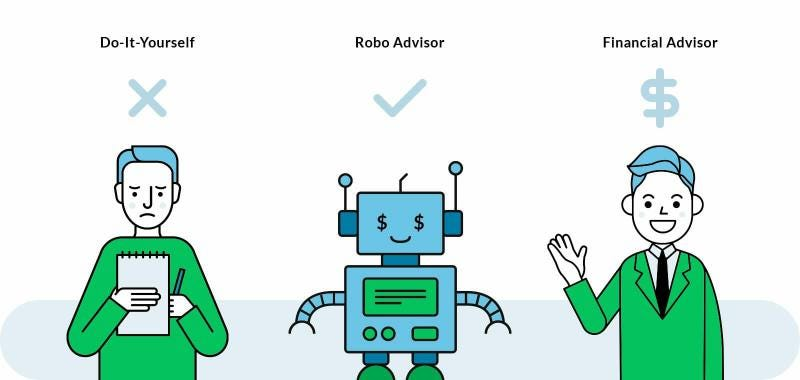

The 2008 market clash underscored the limitations of traditional financial institutions, demanding new innovations to assist in investments. Investors began to lose faith in human financial advisors, leading to the emergence of robo-advisors as a viable alternative.

Robo-advisors emerged as a technological solution to challenges posed by traditional financial advisory models. They are digital platforms that provide automated algorithm-driven financial planning services with little-to-no-human supervision.

These are some of the strong advantages of Robo-advisors

- Automated Investment Management: Using algorithms to create and manage portfolios, robo-advisors provide a hands-off approach, appealing to individuals who find traditional investing complex and time-consuming.

- Lower Costs: By automating processes, robo-advisors reduce fees, making investment advice more affordable compared to human advisors.

- Greater Accessibility: Online platforms simplify account setup and management, making investment services more accessible to a wider audience.

- Transparency and Control: Clear fee structures and real-time investment monitoring, offering investors more control and transparency compared to traditional financial systems.

Betterment-launched in 2008, and Wealthfront-launched in 2011, were among the first companies in the robo-advising space that quickly gained recognition and attracted substantial investment and user growth.

Robo-advisors collect details from customers through a questionnaire and then use algorithms to create personalized investment strategies based on their financial goals, risk tolerance, and time horizon.

Evolution of AI in Investment Services

Initially focused on basic portfolio management, robo-advisors have incorporated advancements in artificial intelligence (AI) and machine learning to transform financial advice.

With the advancement of technology, new AI-powered investment platforms similar to robo-advisors have entered the market. This has expanded the reach of AI in investments, allowing a broader range of ordinary people to benefit from AI in their investment journeys.

New AI investing platforms started to hit the market which use the advanced versions of

- Machine learning algorithms: Can analyze extensive financial data in real-time, identifying patterns and trends to facilitate more informed trading decisions.

- Deep Learning (DL): DL algorithms utilize advanced neural networks, resembling the human brain, to extract meaningful insights from unstructured data like text, audio, and images.

- Natural Language Processing (NLP): NLP enables computers to understand human languages in news articles, online sentiments, and other information, helping identify market-moving events and assess investor sentiment.

- Large Language Model (LLM): LLM is a type of AI model capable of processing and generating human-like text. These models, like GPT-3, are trained on vast amounts of text data and can be used for various natural language processing tasks, such as answering questions, generating content, or assisting with language translation.

Even established financial advice firms like Vanguard have entered the digital advisory space, offering AI-enhanced robo-advisory platforms.

Generative AI, an advanced form of AI (e.g., chatGPT), has already made its entry into the financial services sector. Investment services powered by generative AI, utilizing the advanced AI versions listed above, are emerging as significant transformative forces in the industry, paving the way for a future dominated by AI advancements.

This evolution of AI has not only benefited individual investors but has also streamlined workflows for investment firms and advisory businesses. While some AI platforms directly serve investors, others assist financial professionals by reducing the time they spend on certain tasks, thereby simplifying their workflows and enhancing their productivity.

For eg, companies like HoopsAI and TrendSpider are providing detailed analyses of investment products such as stocks, cryptocurrencies etc, and suggesting tailored strategies – helping investors to streamline their investment process.

HoopsAi claims that their patent-pending technology utilizes Natural Language Processing (NLP), machine learning, and Generative AI to analyze real-time data feeds from markets, social media, news, and other sources. This innovative approach allows HoopsAI to autonomously create compelling headlines, conduct market research, and provide in-depth insights and analysis.Then there are Vise intelligence and OpsGPT like generative AI tools that help advisory firms and financial professionals.

Vise Intelligence: Similar to ChatGPT, Vise Intelligence claims that they utilize Large Language Models (LLMs) fine-tuned with data to improve operational efficiency and client portfolio communication in the wealth management domain.

OpsGPT by Broadridge: OpsGpt also claim that they utilize LLM to simplify and optimizing trading operations by automating operational tasks. This automation saves a significant amount of time for advisory firms and financial professionals.

The Future of AI in Finance

The Global AI in Fintech Market was valued at $8.23 billion in 2021 and is projected to reach $61.30 billion by 2031, with a compound annual growth rate (CAGR) of 22.5% from 2022 to 2031.

This indicates a significant increase in spending by financial institutions and investment advisory firms to leverage the power of AI in their services.

Also, the online trading market is expected to grow by $3.8 billion by 2028!

New inventions aimed at simplifying the investment journey are on the horizon. In the future, personalized investment strategies may incorporate cultural and personal values, making robo-advisors feel more human-centric and approachable for financial advice.

The idea of a financial advisor at your fingertips will only tend to increase its impact on the people and it will only tend to grow by year by year.

But does that mean AI will replace every human involvement in investment services?

Absolutely not. AI does not replace expertise in finance and economics; rather, it complements and enhances it. Having a strong foundation in traditional finance and economics remains crucial in these fields. As AI models continue to evolve and become more efficient, the professionals and investment firms that can integrate AI with their expertise and utilize it effectively will shape the extent of AI’s involvement in the investment arena.

If AI were to completely replace humans, companies would solely focus on more advanced robo-advisors and investment platforms. However, this is not the case. Instead, we are witnessing a significant increase in tools like OpsGPT by Broadridge that assist financial professionals and investment advisory firms in streamlining their work.

With the AI boom in 2023 and AI evolving like never before, we can anticipate more surprising innovations in the future.

How to Use AI in Your Investment Journey?

AI has ushered in a new era in finance, reshaping the investment landscape with its myriad advantages, despite encountering some challenges along the way. Harnessing the power of AI opens doors to enhanced data analysis, streamlined market research, pattern recognition, and the integration of AI-driven insights into investment decisions.

Yet, as we forge ahead, a significant obstacle looms large: the investment sector boasts a rich history dating back over 400 years, marked by continuous evolution, economic downturns, and seismic market collapses such as those witnessed in 1929 and 2008.

Additionally, geopolitical upheavals wield considerable influence over market dynamics. Since 1928, there have been 25 bear market events, each defined by a substantial drop in stock values.

The surge in popularity of AI-powered investment platforms in 2023 marked a significant milestone, highlighting the nascent stage of AI’s integration within the investment sphere. However, it’s crucial to acknowledge the uncertainties surrounding AI’s response to bear markets and geopolitical turbulence, which could potentially disrupt market equilibrium.

Thus, while AI offers invaluable insights, solely relying on its suggestions for investment decisions may not be wise. Instead, a balanced approach that combines AI-derived metrics with human expertise is advisable. Qualified professionals possess the nuanced understanding required to navigate these complexities, utilizing AI as a complementary tool rather than a sole determinant.

Enter Moolaah –Moolaah provides a holistic platform, empowering investors to evaluate the performance of assets comprehensively. With the assistance of an AMFI-registered Mutual Fund Distributor, users gain access to a diverse array of investment options, from stocks to bonds and beyond.

At Moolaah, your investment journey is personalized and supported by seasoned experts who tailor recommendations to align with your financial aspirations. Whether you’re a seasoned investor or just starting, Moolaah serves as your trusted ally, offering a seamless blend of technology and human insight to craft and execute your investment strategy.

Embark on your investment journey with Moolaah – where informed decisions meet personalized guidance, shaping a future of financial prosperity.